Bush's Solution is for Workers to Pay More; Corporations to Pay Less

by Tula Connell

Yesterday, union members in Wisconsin succeeded in introducing commonsense legislation that would ensure all state residents have access to quality, affordable health care.

But the rest of the nation isn’t so lucky.

Not only are uninsured rates among U.S. adults rising, but there has been a marked jump among people with modest incomes, says a new study by The Commonwealth Fund.

According to Gaps in Health Insurance: An All-American Problem, prepared for the fund’s Commission on a High Performance Health System:

Two of five working-age Americans with incomes between $20,000 and $40,000 a year were uninsured for at least part of the past year—a dramatic and rapid increase from 2001 when just over one-quarter of those with moderate incomes were uninsured, according to the new report,

The survey finds that most of these individuals are part of working families: Of the estimated 48 million American adults who spent any time uninsured in the past year, 67 percent were in families where at least one person was working full-time.

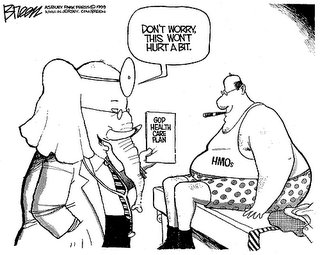

In his State of the Union address last January, President George W. Bush proposed so-called Health Savings Accounts—a program that would cost consumers more while offering less health care.

Making workers pay more and corporations pay less is Bush’s answer to the nation’s health care crisis—like his answer to so many of the other disasters piling up under his administration.

Of the nearly 46 million Americans without health insurance, nearly one-quarter—or more than 10 million—are children.

Something needs to be done. The AFL-CIO supports universal health care. But as AFL-CIO President John Sweeney says:

Until we have a new administration and a new Congress that give a damn about the people of this country, we’re taking the fight for affordable health care to the states.

Wisconsin is just the beginning.

No comments:

Post a Comment